The total revenues generated by the global cinema industry this year are set to only reach half of 2019’s pre-COVID revenues according to Omdia’s latest Cross Sector Windows report. Global box office revenues are still being impacted by studios experimenting with differing release windows, alternative platform distribution models such as video on demand, as well as government restrictions and more recently, a change in consumer confidence due to the Delta variant.

The total revenues generated by the global cinema industry this year are set to only reach half of 2019’s pre-COVID revenues according to Omdia’s latest Cross Sector Windows report. Global box office revenues are still being impacted by studios experimenting with differing release windows, alternative platform distribution models such as video on demand, as well as government restrictions and more recently, a change in consumer confidence due to the Delta variant.

In addition to reacting to the global conditions, studios are also experimenting with different release strategies as a coordinated way to build their own platform subscriber bases. One of the major challenges faced by studios with the move towards hybrid streaming strategies has been the increased issue of online piracy and accessibility of titles from launch.

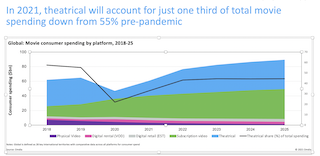

Overall, in 2021 consumer spend for movies across all platforms including streaming, traditional home entertainment and theatrical will account for $60.4 billion, down $5 billion from pre-pandemic levels. At the height of the pandemic, the total movie spend recorded just $46 billion with the largest share from a growing streaming base.

By 2022, with cinemas in a stronger position, Omdia forecasts that total movie spend will rise to a record $80 billion globally. Mid recovery, cinema will generate just one third of consumer movie spend this year compared with more than 55 percent pre-pandemic.

Within the report, Omdia compared the traditional cinema and home entertainment revenue of a top 50 2019 title with how it would perform across different pandemic-era release strategies. The scenarios take into account a relative cannibalization of traditional windows by each strategy and offers how much missing revenue needs to be made up for through subscriber gain or incremental streaming revenue.

The baseline transactional revenues for a typical major blockbuster are around $300 million per title of which cinema revenues are $178 million per title. In the US typically, 60 percent of aggregate revenue is generated within cinemas, with 75 percent of this generated within first 17 days/three weekends of release into theatres.

The biggest impacts for exhibitors from shifting windows have most certainly been the introduction of day and date release windows across both SVOD and PVOD platforms including some of the largest titles of the year.

Day and date releases accounted for 54 percent of box office revenues in US cinemas up to mid-June 202. Omdia expects that studios will predominantly migrate back to a theatrical first strategy for major titles over the next few months. Day and date releases have been a way to ensure that people are still viewing blockbuster films either in cinema or at home during the recovery.

Omdia’s scenarios suggest day and date releases to streaming services would have the most significant impact on a title’s box office by as much as 20 percemt. Whereas minimally cannibalistic strategies such as a 45-day exclusivity window would have impacted box office takings by closer to 5 percent, and alternative distribution models such as dynamic PVOD and day and date PVOD also fall into this range (5-20 percent). However, in each scenario, traditional home entertainment revenue was put at greater risk over theatrical.

Charlotte Jones principal analyst at Omdia said, “The COVID-19 pandemic has had a significant effect on studio revenues and shifted the way in which movies have been released. Theatrical windows are still a key revenue generator for studios and whilst there has been experimentation with alternative platforms and distribution models, over the course of the next few months studios will return to theatrical exclusivity for key blockbuster titles before releasing on other platforms.

“Blockbusters will continue to drive the most amount of box office revenue for cinemas, however it is the tier two [and] tier three titles that will see their window models shift, resulting in a larger decline in the traditional revenue measurement for studios. Conversely, flexibility in release windows will also admit a wider variety of content into cinemas”